[

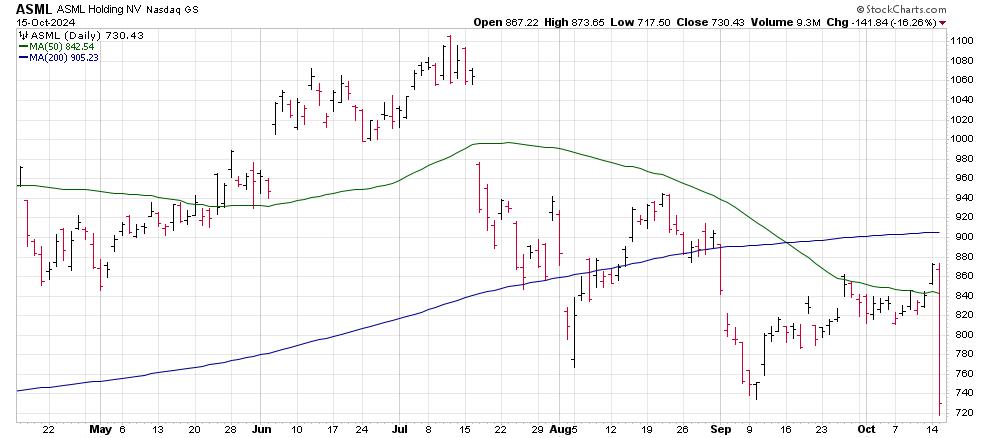

ASML Holdings

Shares ASML Holdings (ASML) fell off the table this morning at 10:20 stunning most investors as a “technical error” resulted in a partial release of the company’s earnings results were leaked on its website.

The company officially released the full report shortly after the leak with the following statement…

“Due to a technical error, information relating to our Q3 2024 results was erroneously published earlier today on part of our website asml.com. For transparency, ASML brought forward publication of its full Q3 2024 results to October 15th. All Q3 2024 content is available on our website at www.asml.com/en/investors”

Those results showed that ASML had slightly missed both its top and bottom-line earnings results as, despite the company’s revenue growth matching expectation.

Those results were accompanied by the news that ASML was lowering their earnings guidance for the next quarter and fiscal year 2025.

The company said it expects net sales for 2025 to come in between 30 billion euros and 35 billion euros. That guidance it at the lower half of the range that ASML had previously provided.

The weak outlook hangs on lowering demand forecasts from China due to growing export restrictions.

Originally, ASML management had expected revenue from China to account for almost 50% of its revenue. That number has been lowered to 20%.

Shares of ASML narrowly missed swinging into a long-term bear market trend last month as the stock faced closing below its 20-month moving average. That trendline sits at $780.

Today’s selloff has firmly moved the stock below that critical support, resulting in a downgrade to the 6-12 month outlook.

Investors should expect the round-numbered $700 to act as support with a high probability that ASML may target $600 over the next six months.

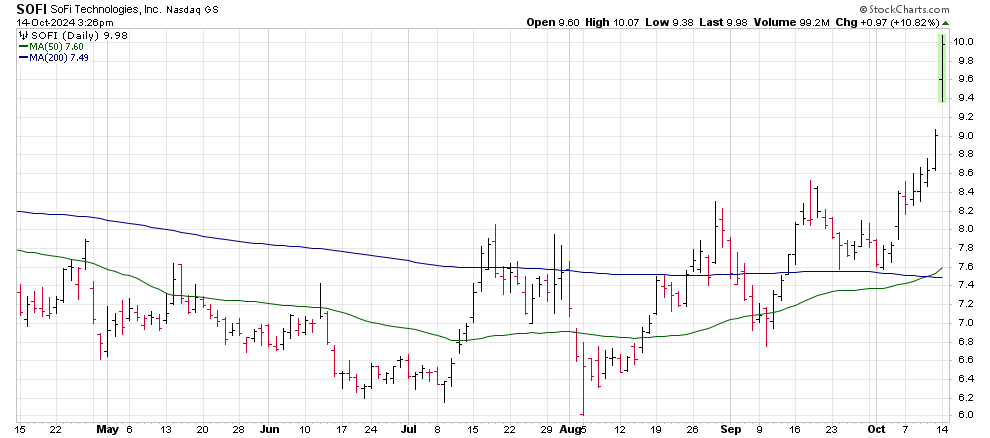

Alibaba

Alibaba (BABA) shares tumbled 5.5% on Tuesday, breaking through a short-term technical trendline.

Shares of the Chinese online retailer have dropped more than 13% over the last seven trading days as investors grow more worried above China’s economy.

Almost a month ago, China’s finance Ministry moved to start stimulating the flagging economy.

China’s central bank did this by reducing mortgage rates for existing homes and reducing the amount of cash commercial banks are required to hold in reserves.

The move sent Chinese stocks shooting higher as investors expected more stimulus announcements to follow.

Since that announcement, China’s central banks has moved on additional stimulus plans focused on military spending rather than consumer activity. The follow-up has been seen by investors as lacking, triggering short-term profit-taking.

Alibaba shares broke through their short-term 20-day moving average today as selling volume increased. The 20-day trendline is referred to as the “Trader’s Trendline” as moves above and below it will trigger short-term reactions in a stock.

Alibaba investors can expect to see some support at $100, but that would be short-term in nature unless additional stimulus is announced quickly by the Chinese central bank.

Shares of Alibaba have been in a long-term bear market trend since May of 2021 and maintain a short-term price target of $85.

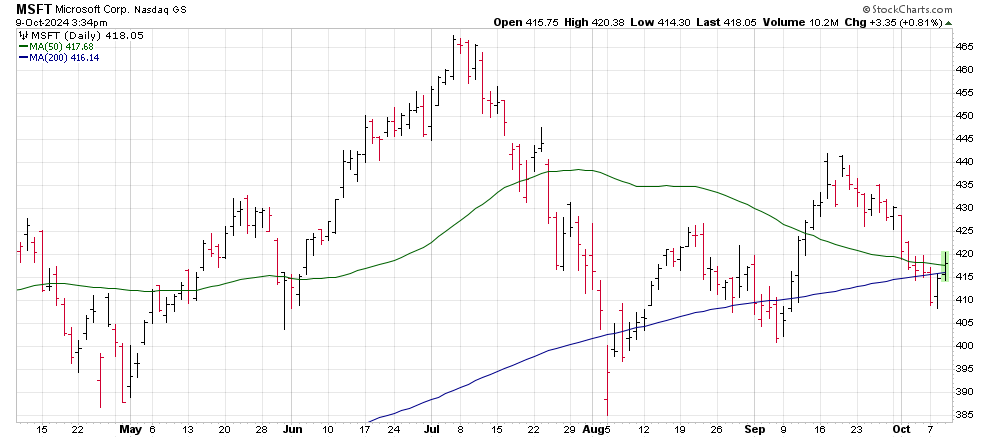

The Charles Schwab Corporation

Shares of Charles Schwab (SCHW) closed Tuesday’s trading more than 6% higher after the company presented strong earnings results this morning.

The most recent quarter’s earnings beat analyst estimates on both revenue and earnings per shares as the company’s online brokerage business showed strong results.

Assets gathering and growth by the company posted strong results as investors continue to participate in bull market conditions. That activity helped Schwab post revenue growth of 5.2% compared to last year’s results.

Schwab’s advisory services grew 6% for the quarter and 26% on a year-over-year basis. Those figures along with continued growth in account trading and strong client engagement combined for the strong revenue beat.

Shares of Schwab had seen a significant rally ahead of the report, though they stopped just short of crossing above their 200-day moving average.

That resistance was notably shattered today as the stock has been propelled to $72.50 to surge to almost the exact price that the stock traded at just before last quarter’s poor earnings report.

With both the 50- and 200-day shifting into bullish trends, Schwab’s stock has avoided slipping into a long-term bear market trend because of today’s results.

Shares of The Charles Schwab Corporation maintain a bullish outlook with a target of $80.