[

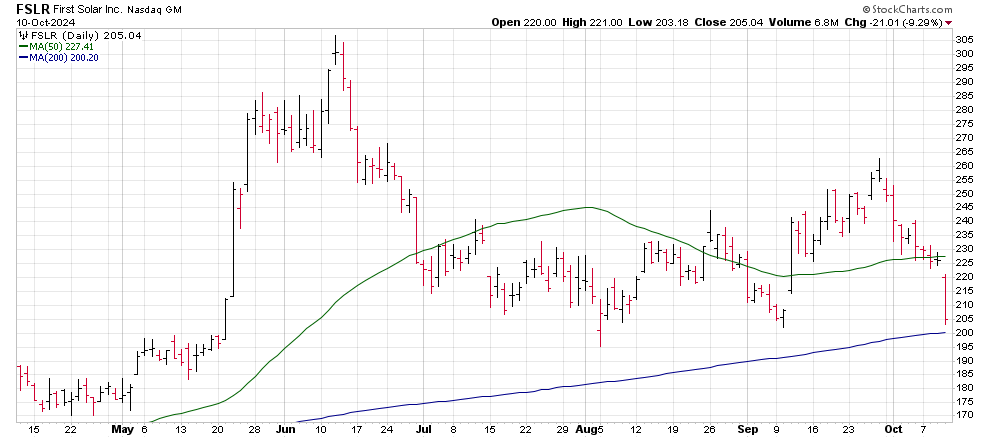

First Solar

Headlines struck First Solar (FSLR) stock today as the Justice Department filed suit against the solar panel company. The suit alleges that First Solar has unpaid duties and penalties on imported Chinese solar panels.

News of the suit sent shares more than 9% lower during Thursday trading putting the stock in a dangerous position.

Shares have been battling to stay above the $200 level since July of this year as First Solar shares have traded in a wide trading range.

The last ten trading days have seen dramatic selling as the stock fell from $26 to their current price of $205.04. The shift in price momentum just sliced through potential support at the stock’s 50-day moving average this week.

Now just above $200, the stock is threatening to break through its 200-day moving average and round-numbered support from that price.

A shift below that important price would then put the stock’s 20-month moving average “in play” immediately. A break below that price would then put First Solar shares at risk of breaking into a long-term bear market trend.

First Solar is current has a neutral rating with a high likelihood of falling into a bear market with a price target of $150.

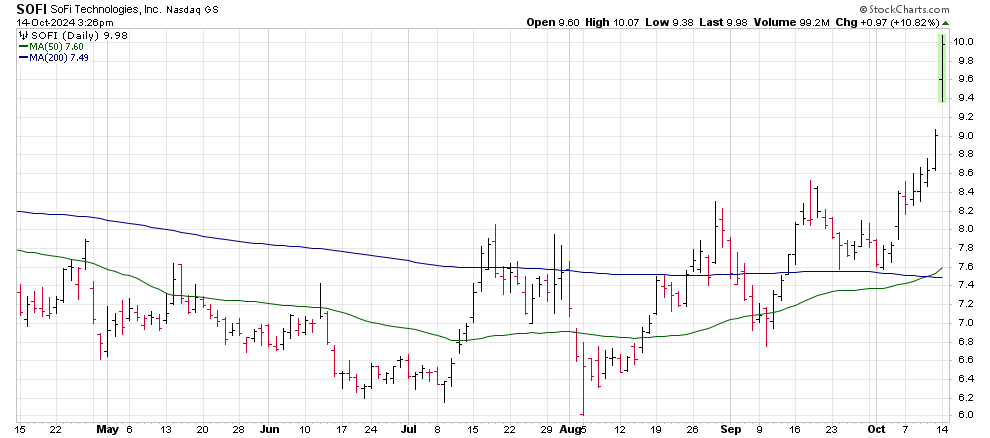

Domino’s Pizza

Domino’s Pizza (DPZ) shares slightly lower today after the company released its current earnings results.

The results beat analysts’ expectations by $0.54 coming in at $4.19 per shares, though the company’s revenue results were lower than projected.

For the quarter, Domino’s revenue grew by 5.1% over the same period last year. While most of the business results were as expected by the company, revenue from lower-income customers in the delivery business lagged.

The results mimic some of the retail stocks earnings over the last quarter as many discount retailers showed signs that their customers were tightening budgets.

Domino’s shares had been trading higher in early trading, but quickly reversed as the stock hit resistance at its 50-day moving average.

The stock’s 50-day trend has been in bear mode since the company’s results in July.

Investors will want to watch the $400 level closely as a move below that price will signal the beginning of a bear market trend for the stock.

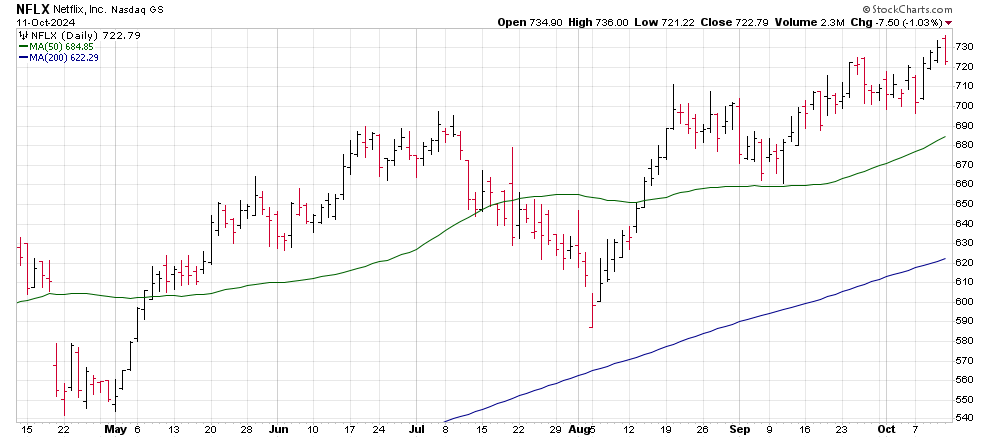

NVIDIA Corporation

NVIDIA (NVDA) shares fortified their breakout of the recent trading range with today’s 1.6% gains.

The stock has been mired in a wide trading range since the beginning of July as investors appear to grow weary of NVIDIA’s valuations.

That situation was magnified when the company presented a bullish, though not wildly bullish, outlook for the next quarter during the company’s latest earnings report.

This week’s trading has made a notable move higher to shift the stock’s technicals back into bull market mode.

As of Monday, NVIDIA’s 50-day moving average resumed its bullish trend for the first time since July.

The move comes as investors prepare for the upcoming earnings season, set to kick off next week.

While NVIDIA won’t report their results until mid-November, investors have historically bid the stock higher in the week ahead of earnings in anticipation of the AI giant’s results.

Just one thing stands as a hurdle for the stock over the next week, the $140 price level. That is the price that NVIDIA shares saw as their all-time highs in June.

Beyond that, Investors will want to focus on $150 as a target price over the short-term ahead of the November 17 earnings report.