[

SoFi Technologies

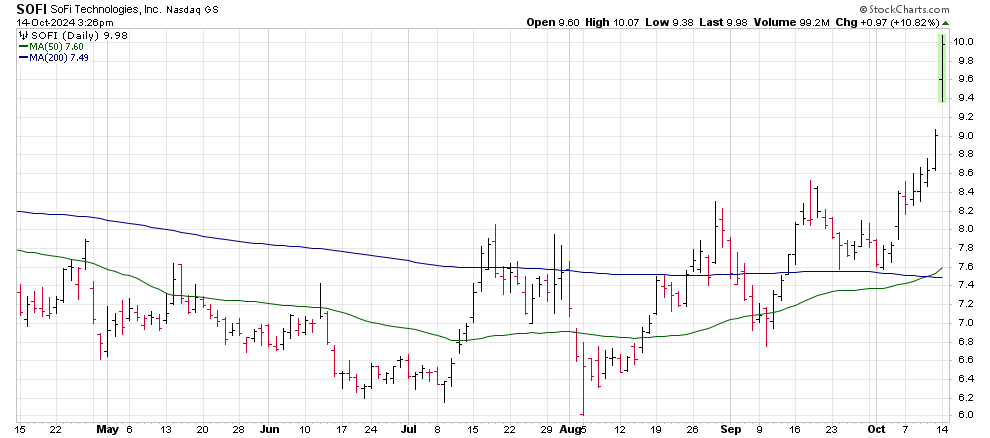

Last week, call option activity on SoFi Technologies (SOFI) saw a surge as traders aggressively increased trading volume of the $8.50 strike options.

Today, shares of SOFI surged another 11% after the company announced an expansion of their loan platform business.

Headlines ahead of the market open on Monday detailed a new $2 billion loan platform deal agreement with Fortress Investment Group.

The deal expands SoFi Technologies capabilities to refers pre-qualified borrowers to loan origination partners as well as originates loans on behalf of third parties.

Investors have been increasingly optimistic towards SOFI stock over the past ten weeks. A combination of lower interest rates, healthier consumer spending activity and a more robust outlook for the economy has resulted in a 65% rally in SoFi shares since early August.

That rally has put SoFi shares in a position to break above the psychologically significant $10 Price. Shares haven’t traded above that price since December of last year.

Historically a move out of the sub-$10 price level attracts larger swaths of investors, both retail and institutional.

Last month, the stock moved above its 20-month moving average, putting shares in a long-term bull market trend.

Investors will want to be aware of SoFi Technologies earnings report set for October 29.

Shares of SoFi are in a new bull market trend with a target price of $12.50.

Sirius XM Holdings Inc.

Sirius XM Holdings (SIRI) jumped more than 8% on Monday as investors reacted to the announcement that Warren Buffett’s Berkshire Hathaway had increased its stake in the media company.

Berkshire reported the purchase of around $87 million in Sirius XM Holdings, adding to the portfolio management company’s existing stake. Buffett also confirmed his passive investment stake in the company of 31.01%.

News of the increase in Buffett’s holding comes just weeks after Sirius XM completed the spin-off from Liberty Media.

At the time of the spin-off, Sirius XM announced that the company would continue its recurring dividend and share repurchase plan. The stock currently pays a dividend yield of 3.92%.

Shares of SIRI have been in an intermediate-term bear market trend since mid-September. At that time, the stock’s 50-day moving average turned negative.

The stock has spent much of 2024 in a bearish trend as shares have lost 49% of their value for the year.

From the longer-term view, shares of SIRI have remained in a long-term bear market trend since January of 2023 and have lost 51% of their value since that transition.

Sirius XM Holdings remain in a long-term bear market with a target price of $20.

Citigroup

Banking giant Citigroup’s (C) shares are eking out another day of small gains ahead of the company’s earnings report tomorrow morning.

Citigroup stock has rallied more than 5% over the last week as investors have been clearly “buying the rumor” before the company’s quarterly results hit the tape.

Last quarter, Citigroup’s stock made a similar move as the stock traded higher by more than 6% ahead of the earnings report.

Shares dropped more than 1% following the company’s better-than-expected earnings report as traders quickly “sold the news”.

For the quarter. Citigroup’s performance showed earnings that were $0.13 better than analyst’s target on revenue that also exceeded the market’s targets. More impressive was the 3.6% year-over-year earnings growth, breaking two consecutive quarters of shrinking revenue comparisons.

On Friday, JP Morgan (JPM) shares had an explosive response to the company’s solid earnings report.

Those shares also saw impressive buying ahead of the numbers, suggesting that investors are willing to follow through on strong earnings results this quarter.

Citigroup will announce their earnings results tomorrow morning ahead of the market open.

Shares of Citigroup maintain a long-term bullish outlook with a price target of $100.