[

Technology Stock of the Week: Netflix

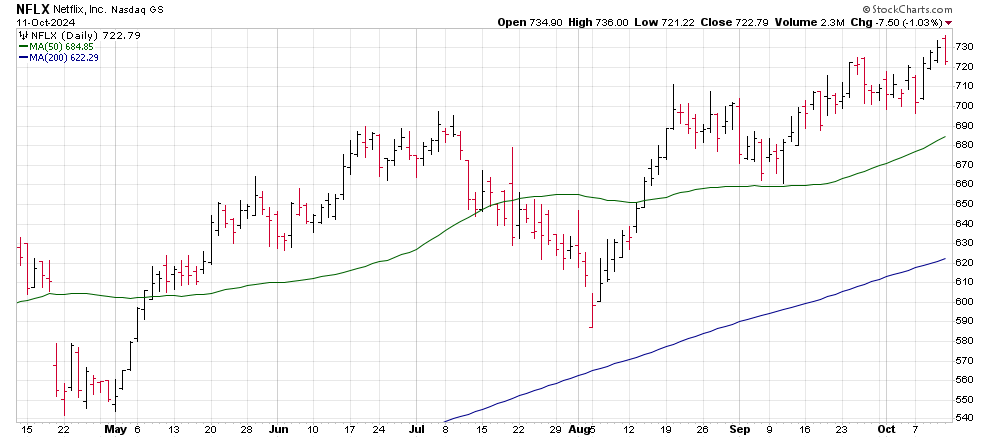

Netflix (NFLX) is scheduled to deliver its quarterly earnings report on Thursday after the market’s close.

The streaming company is expected to deliver earnings per share results of $5.09. Last quarter, after beating Wall Street’s estimates, Netflix raised their earnings target to $5.10.

The guidance raise indicates two things.

First, Netflix is back on track to take the leadership role in the streaming industry after three years of the industry becoming crowded with competition.

Second, Netflix will have to deliver even stronger numbers than they forecasted to maintain their short-term bullish trend.

Last quarter’s results – while better than expected – failed to blow investors’ hair back since the company had raised their guidance in April. Like what we saw in July.

Netflix shares dropped almost 10% in the weeks following the July report as investors were expecting even more!

The 10% rally was a great buying opportunity as the stock now trades 22% higher than its post-earnings bottom.

Keep an eye on Netflix to provide another “sell the news” post-earnings opportunity to grab shares on a relative bargain ahead of their next surge higher.

Growth Stock of the Week: Uber

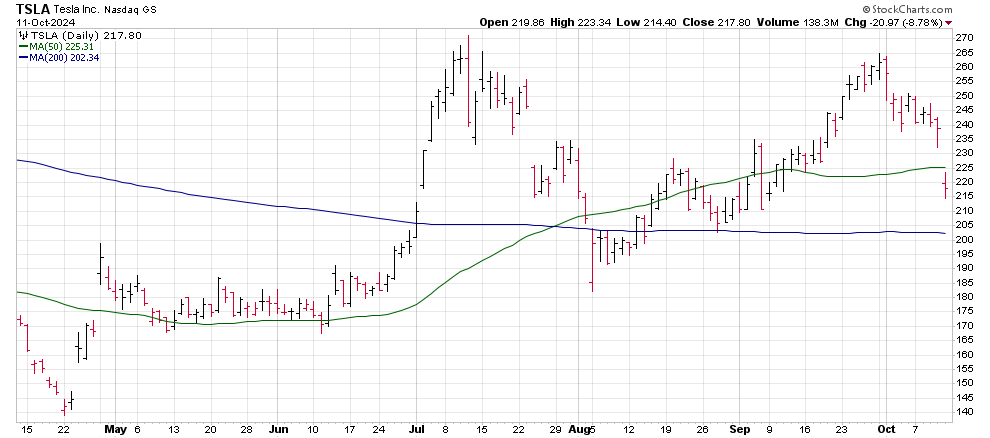

Uber (UBER) shares attracted buyers on Friday as investors reacted to Tesla’s (TSLA) “Me, Robot” event.

Tesla’s much ballyhooed event fell short of investors expectations as the event was heavy on vision and light on details.

The results of investors disappointment could be seen in Tesla’s 8% decline on Friday and Uber’s 10.8% gains, but there’s more.

That rally broke Uber stock above the $80 price level, sparking what is likely to be another volatility rally higher for the stock.

The move also struck new all-time highs for Uber.

Uber’s next earnings report is due on October 31.

Last quarter’s report showed revenue growth of 15.9%, continuing a trend of improvement that started more than a year ago.

Stock Under $10 of the Week: SoFi Technologies

Fintech company SoFi Technologies (SOFI) saw a surge of buying as investors continue to see improvements in consumer discretionary behavior.

The stock also benefitted from an analyst upgrade to peer company Upstart (UPST) last week, the second upgrade within the industry in just three days.

SoFi shares have rallied almost 15% in October as the stosk has continued to see strong trading volume drive prices higher.

That move has resulted in a Golden Cross pattern forming as SoFi’s 50-day moving average crossed above its 200-day moving average on Thursday.

A Golden Cross technical pattern is a pattern that forms as a stock’s long-term momentum improves. The pattern is known for forecasting higher prices for a stock over the next 3-6 months.

SoFi stock closed Friday at $9.01, just slightly above the round-numbered resistance of $9.00.

Investors should expect that the stock’s next surge will carry the stock above $10 for the first time since December 2023.

Income Stock of the Week: Duke Energy

Duke Energy (DUK) and other utility stocks have seen a little selling over the last two weeks, but these stocks are far from done with their bull market run.

Duke shares post a yield of 3.6% in dividend income. Sure, there are other utility companies that pay more, but few have the added growth potential that Duke Energy has.

The stock is one of the few regional power companies that has potential to begin working with AI and data center companies to provide dedicated power to fulfill the growing power needs generated by AI.

Duke Energy shares reflect that potential as shares are currently trading 32% higher over the last year as the stock continues trading in a strong bull market trend.

Shares have jumped from $100 to $118 since July, but saw a surge of selling last week. That selling pressure dipped Duke shares below their bullish 50-day moving average, indicating that the stock may be presenting a “buy the dip” opportunity.

Watch for a move back above $115 to signal that the stock is set to make its next advance to the $125-130 price zone.

Bearish Stock of the Week: Dillard’s

Dillard’s (DDS) slipped right through the earnings season with little notice, but the department store retailer is in a spot for sure.

Last quarter’s earnings were dismal. The company missed the earnings per share target by -$1.38 as revenue came in lower than expected. Even worse, Dillard’s revenue showed a decline of -6.7% year-over-year. The company has seen negative revenue growth for six consecutive quarters.

Investors need to worry about the stock as it approaches $360, again. That price is where Dillard’s 20-month moving average sits, meaning that a break below $355 or so will put the retailer’s stock back in a long-term bear market trend.

Aggressive traders may take the opportunity to hedge the stock for a likely move to $300 over the next 3-6 months.