[

Tesla (TSLA) shares are trading lower after last night’s Robotaxi/We, Robot event.

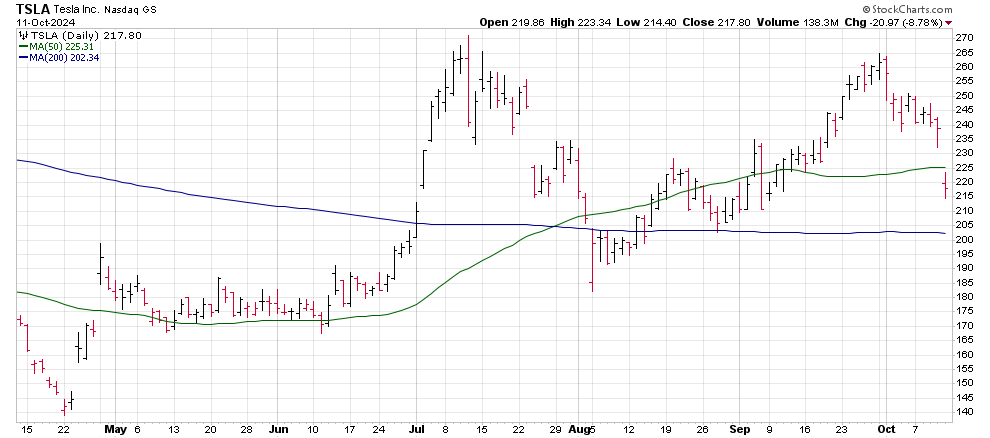

The stock is now trading below its 50-day moving average as it target’s Tesla’s “Hype Bottom” price $180 before the company’s October 23 earnings call.

Most investors don’t know what a “Hype Bottom” is or what it means for the stock, let’s take a few minutes to dig into the details along with what investors should expect from Tesla shares.

The Situation

Originally slated for August 8, Tesla delayed the Robotaxi event back to October 10 to make some design changes and to build more prototypes.

With the setting taking place at a movie studio, the expectation is that TSLA will try to simulate an actual rider pickup and drop-off in a staged downtown area. The expectations were also for a lot of glitz and flash at the event, something that investors may enjoy, but they’re looking more for fundamentals.

Last night, Elon Musk finally hosted the event which left everyone underwhelmed.

That’s a problem for Tesla shares today as the stock is already trading 8% lower and heading to a familiar battle line price at $200.

What Happened

The event dubbed “We, Robot” had all the pomp and circumstance that investors expect from Elon.

Products unveiled included unveiling of a 20-person autonomous bus as well as updates on the Cybercab and Optimus projects.

What was missing were details.

Details on a business plan for the Cybercab beyond stating that someone could buy one for around $30,000.

Details on how Optimus fits into Tesla’s business plan and would translate into revenue and earnings for Tesla stock over the next five years.

And maybe more importantly, details on the Rollout of the low-cost Tesla Model 3 and Y.

This is widely seen as the project that can cross the finish line the fastest for Tesla, meaning that any tangible update would have immediately help drive the stock’s price higher.

It was a cool show, but that’s all and the show is over (and it was short).

What the Market is Saying

Take a look at the charts of Uber and LYFT this morning and you’ll know what the market is saying.

Both rideshare stocks – the stocks that the Cybercab threaten – are trading roughly 8% higher.

At the same time, Tesla shares are lower by the same amount.

If the market speaks with its money then investors are telling you that it will be a while before Tesla monetizes their ideas.

Analysts are chiming in with the same sentiment.

Oppenheimer analyst Colin Rusch commented “We, Robot event proved essentially a product release party with limited detail on its software and computer platform and its intended business model outside of vehicle sales. There was also no update on its low-cost vehicle production plans nor a demonstration of robotaxi or humanoid functionality in challenging conditions.”

What Happens from Here

Here’s what investors need to worry about.

Tesla’s earnings are just two weeks away on October 23.

The stock formed its last bottom after last quarter’s disappointment when Elon Musk appears to promise that last night’s event would answer all the questions investors have about where the stock is going. It didn’t.

Given that, we’ll refer to the August 8 lows as the “Hype Bottom”.

That August 8 date is now on the table as a target ahead of the earnings report because the market was buying shares out of the bottom based on the inflated expectation that the We, Robot event would jettison the stock higher.

This morning, the stock broke below $225 which is where shares initially traded the morning after Tesla’s last earnings report.

Those that closely watch Tesla will take that as a Warning that shares are on a trajectory to the August 8 lows again.

From there, Tesla’s earnings become one of the most important that the company has delivered this year.

Failure to provide a detailed update on the low-cost Tesla models – with a production timeline and availability dates – will send the stock back below $200 with a target price of $150.

How to Trade it

Tesla bulls will want to consider how low they are willing to go with the stock.

Shares are resting on their 20-month moving average – currently at $217 – which has been a line in the sand for the stock each of the last four months.

A meaningful break below that trendline after the company’s report will spell more selling for Tesla stock. That, along with a move below $200 would spell long-term trouble for Tesla’s 6-month outlook.

Aggressive traders may want to consider a hedge or shorting Tesla using derivatives.

I say “derivatives” because there are multiple ways to add an effective hedge on Tesla to a portfolio.

The GraniteShares 2x Short TSLA Daily ETF (TSDD) offer one way to hedge Tesla’s decline in share value.

This ETF holds a portfolio of put options designed to deliver close to twice the inverse returns of Tesla daily. For example, if shares of Tesla are trading -5% lower, the TSDD shares will be approximately 10% higher on the same day.

Keep in mind that the inverse funds, especially those that offer leverage, are meant to be used as active trading tools, not long-term investments. These investments will have a tendency to lose value through “slippage” and are meant to be short-term in the nature of their use.

Of course, those with option experience may consider the use of at- or in-the-money puts on Tesla to actively hedge a long stock position.

Earnings reports and the volatility that they bring are always a consideration of options positions on a stock. Keep that in mind over the relatively short time period existing between now and the company’s earnings report.