[

Microsoft

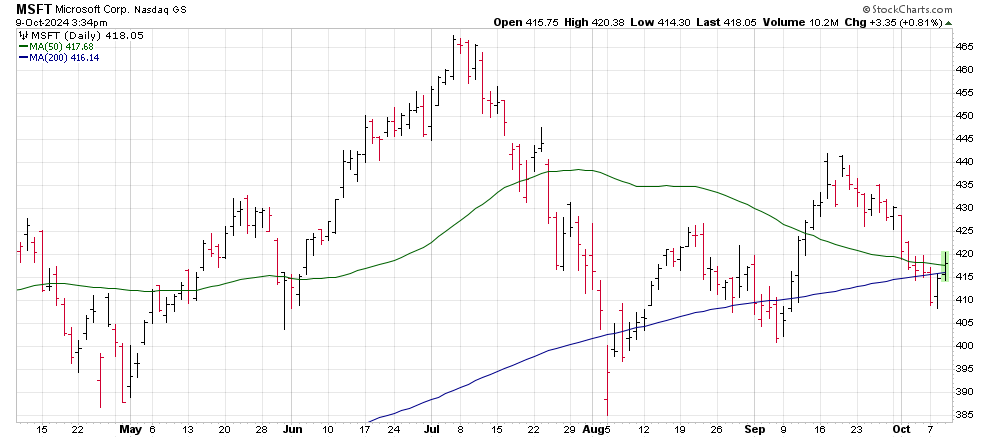

Microsoft (MSFT) shares got a much-needed boost above critical trendline support today.

Shares of Microsoft dipped below its 50- and 200-day moving average on Monday to trade as low as $410 dollars.

The move is critical as Microsoft’s 50-day moving average is currently trying to transition into a bullish trend. That trend line slipped into a bearish pattern in the beginning of August following the company’s earnings results in late July.

Since August 1, Microsoft, Amazon (AMZN) , and Alphabet (GOOGL) have all underperformed the rest of the Magnificent Seven stocks and the Nasdaq 100. Microsoft’s return over that period matches Amazon’s with a loss of -1% while Alphabet is trading -4% lower for the period.

Investors continue to question the company’s ability to monetize their large investments in AI after management lowered revenue guidance for the company’s upcoming earnings report. That report is set to be released on October 22, after market hours.

Microsoft’s 200-day moving average has served as staunch support. Since the beginning of August, Microsoft shares have temporarily dipped below that long-term trendline three times.

The last break of this critical trendline was just two days ago as shares dropped 1.6% below their 200-day trendline.

Failure for the stock to remain above the $410 price will cause a longer-term shift in price momentum as technical traders will become more nervous about the potential for the stock to survive another weak earnings result.

For that reason, investors may want to wait ahead of that report before adding to shares as the risks appear to outweigh the rewards for trying to time the stock.

From a longer-term perspective, Microsoft remains in a long-term bullish trend with a price target of $500.

Boeing

Boeing’s (BA) troubles continue to plague the stock.

Early morning news from Arlington was not good as the company announced it had withdrawn the contract offer for machinists. Boeing continued by stating that further negotiations did not make sense at this point.

Shortly afterward, S&P announced that the company had been placed on “Credit Watch Negative” noting that the company’s month-long strike had contributed to the rating decision.

Later in the day, Reuters also reported that Boeing is in the process of considering various measures to raise cash in an effort to overcome the company’s cash flow issues.

Options on the table may include stock dilution, either through common stock offerings or other security offerings, as well as large stock sales. Any of those options could weigh additionally on the current share price.

As for the stock’s price, shares dropped another 3.5% today, dipping the stock below $150 for the first time since November 2022. At that time, the stock was rising, not declining.

During the bear market in 2022, Boeing shares dropped as low as $113.02.

Today’s foray below $150 and any consideration of stockholder dilution would likely target a price target of $120 or lower.

The company is set to report earnings on October 23 before the market’s open.

Amazon

Amazon (AMZN) made their presence known in the retail pharmacy and grocery spaces on Wednesday boosting the stock 1.5%.

The company announced that Amazon Pharmacy plans to expand its same-day delivery of medications to nearly half the US in 2025.

Those headlines were closely followed by the company’s report that it was offering more choices “while making grocery shopping faster and easier”.

Both Apple and Amazon performed notably better during Wednesday’s trading, though Amazon stock is struggling to maintain its short-term strength.

After a strong September, Amazon shares have gotten off to a stumbling start to October prepare to test long-term trend support.

The stock is currently hovering just above its bullish 50- and 200-day day moving averages currently residing at $180 and $178 respectively.

Amazon shares sliced through both trendlines in August as the stock reeled from an earnings report that missed investors expectations for revenue.

In addition, Amazon’s management maintained prior guidance for the quarter.

Failing to raise guidance left investors questioning whether the company’s AI business was going to pay off as quickly as the market had expected.

Amazon is slated to report their next quarterly earnings report on October 24 after the market close.

Between now and then investors should maintain a close eye on trendline support at $177 as a break below this price may cause investors to sell the stock ahead of the company’s earnings report.