[

Tesla

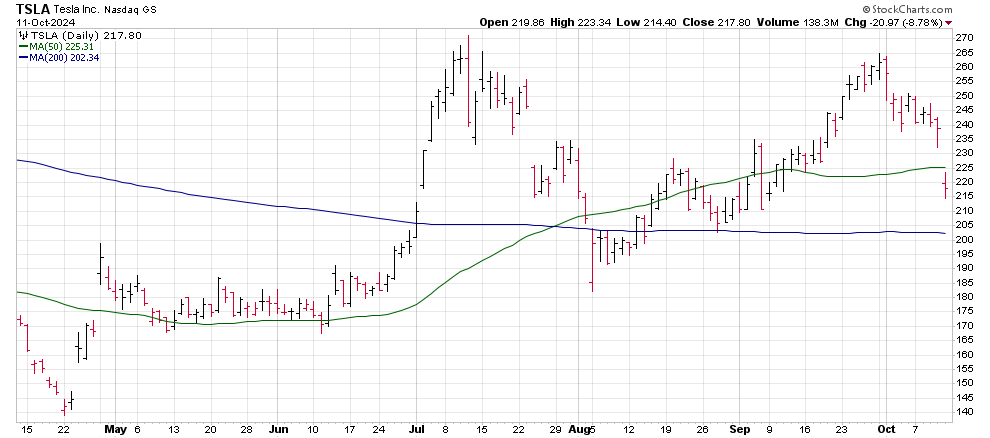

Tesla (TSLA) stock suffered the wrath of disappointed investors today as the stock dropped 8.25 not take the worst performing spot among S&P 500 stocks for the day.

The disappointment came from last night’s We, Robot event. The 30 minute or so event featured Optimus humanoids playing “rock, paper, scissor” and tending bar along with prototype Robocabs, but was light on details and business plans.

As a result, investors and analysts are left uncertain about current valuations and the recent rally in the stock.

Today’s selling shot the stock below its 50-day moving average, a trigger that increased selling from technical analysis algorithms.

Shares also broke through their bottom Bollinger Band, putting investors on alert that more selling is likely with a target of $200.

Tesla is set to announce earnings results in just two weeks, leaving investors to question if the company will provide meaningful updates and timelines for low-price models of the popular 3 and Y vehicles. This may be the company’s best move to regain the confidence of the faithful Tesla investor following.

For now, investors should expect a bumpy ride to support of $200 ahead of the October 28 earnings report.

Longer-term outlooks and price targets will rely on Tesla’s results and outlook on that date.

Uber

Some positive fallout from the Tesla event came in the form of strong buying volume on shares of rideshare companies Uber (UBER) and Lyft (LYFT).

Both companies’ stocks saw increase buying as investors fear less of the impact of Tesla’s Robotaxi on Uber and Lyft’s business models in the foreseeable future.

Uber shares Rocketed more than 10% higher on its strongest volume day since the company’s last earnings report on August 5. That earnings report surprised investors with earnings per share that were $0.47 better than expected.

The stock’s sharp advance pushed them into new all-time high territory as the marched past the previous highs just above $82. Those highs were posted in March of 2024.

The combination of strong fundamentals and less fear of competition from Tesla is likely to attract the attention of Wall Street analysts.

The current average target price of the 53 analysts covering the stock sits just 1% above Uber’s current price.

The last time that Uber shares caught up with analysts’ targets was January 2024. Target prices immediately adjusted higher followed by a 22% jump in Uber shares.

Uber is set to report quarterly earnings results on October 31, making today’s situation eerily close to what the market saw in January.

Uber shares maintain a bullish outlook with a price target of $100.

Bitcoin

Bitcoin’s (BTC) rally didn’t get much coverage from the media on Friday, but its move once again challenges overhead technical resistance.

The cryptocurrency saw an increase of 4.6% on average volume while crossing above its 50-day moving average. That 50-day is in a neutral trend, reflecting the relatively tight trading range of Bitcoin over the last two months.

The resistance the held shares down for the day came from Bitcoin’s 200-day moving average, marked precisely at the highs of the day. That trendline recently slipped into a bearish trend, suggesting that Bitcoin may have a hard time advancing.

Gold made nice advance today on solid volume, suggesting that the move in both may be connected to growing nerves ahead of the General Election less than a month away.

Gold has showed much stronger returns over the short- and long-term timeframes as additional factors like demand from Central Banks around the world fuel its rally.

For now, Bitcoin investors need to eye the $63,500 level for additional resistance. A reversal from that price will target a high probability move to $55,000 and likely lower.

That $55,000 price has served as a short-term bottom for Bitcoin three times since July. Over time, without seeing new highs, stocks and cryptocurrencies that test the same support prices tend to wear them out, causing an eventual break below them.

Bitcoin remains in a long-term bull market trend with the high probability that we will see additional corrections over the short-term outlook.